Legal Tech solutions can streamline the document review process and extract key legal agreement data in a quick and efficient manner surpassing the manual review process traditionally performed by paralegals. The exponential growth in the volume of legal documents and contracts involved in the legal process has made it impractical to rely on traditional processes, which are susceptible to human error, time-consuming and most importantly costly to the end-client. The data contained within these documents is often not captured in an effective manner resulting in many business opportunities being lost through not understanding they key data contained within a firm’s document and contract portfolio. However, these opportunities can be realised through careful utilisation of LegalTech vendor solutions as such solutions can provide firms with greater visibility on data contained within their document and contract portfolio in a fast and efficient manner.

Many of D2LT’s Tier 1 banking clients beginning to embark on utilising LegalTech solutions, benefit from D2LT’s guidance as we are able to navigate and advise on the various solutions currently in the market. Our tech and vendor agnostic approach enables us to work with a number of different providers and through careful research and extensive product testing, we able to successfully align the correct LegalTech solution to our client’s needs and issues.

Digitizing Contracts

Typically institutions will store executed contracts in image form and the text versions (e.g. MS Word) are either not always retained, or there is not enough confidence that the text version available is the final executed version of the contract (and may, in fact, be a slightly earlier draft).

It is difficult to harness the power of machine search and data extraction without therefore converting large portfolios of legacy documentation into machine readable form. This can be done using OCR (Optical Character Recognition) technology. Essentially a system analyses the structure of a document image, divides the pages into paragraphs and tables. These in turn are converted into their constituent lines, words and then characters. At this point, the characters singled out can be compared using sophisticated algorithms against various pattern images. A vast number of probabilistic hypotheses are computed, before presenting the statistically likely character stream.

By utilizing certain technology steps and taking into account the language and drafting style typically used in legal contracts, it is possible to convert image-based documents into machine readable form in a cost-effective and accurate manner.

D2LT has been a thought leader in the market development of enhanced OCR technology and is well placed to assist clients to determine an approach suitable for them.

Document Generation

There is ever increasing pressure to improve the quality of the legal documentation to manage risk, managing non-standard clauses effectively and ensuring appropriate internal authorisations are evidenced. This is balanced by the desire to reduce the cost of documenting these complex transactions and streamline processes. As a result, financial institutions are increasingly embracing document assembly/generation systems, allowing management to obtain key metrics and reports/management dashboards for the documentation process previously only available through very manual data collation exercises.

D2LT has determined that the optimal way to assist clients is to remain technology agnostic in the market. D2LT are well appraised of the competency of the various available options and is, therefore, well placed to advise clients of the optimal toolkit for them based on an understanding of their tailored requirements and their history.

Data Extraction

Financial institutions have struggled in their effective management of legal documentation as a source of reference data for onward consumption. Terms and values of key data points required by downstream consumers are often manually extracted multiple times by consumers, often inconsistently and even inaccurately. In the OTC derivatives market for example, the ISDA documentation is complex and downstream consumers such as those modelling collateral for capital purposes and CVA desks, require very granular data.

In the increasingly regulated world, with new regulations such as MIFID II, QFC, MRUD, GDPR, Basel IV, and EMIR, the manual extraction of data points across these legal documentation portfolios is clearly inefficient and costly. Structured data and technology assisted solutions are required, such that the addition of an extra data point is seamless and does not require a fresh review of the entire document portfolio.

D2LT is also actively involved in industry initiatives to structure data more effectively which will also serve to enhance a firm’s ability to leverage technology to use the data efficiently.

Systems Selection

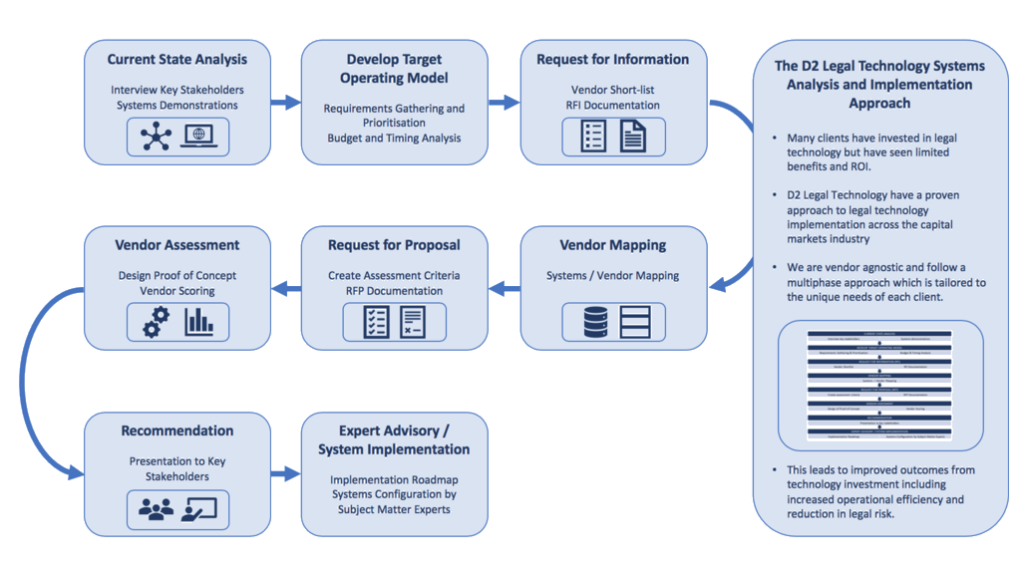

As a technology agnostic legal data consulting firm, D2LT is uniquely positioned to assess the available technology solutions in the market and to make recommendations that offer best in class outcomes for clients.

We consider that by understanding the client firms infrastructure, and the decisions that have been made in the past, we can assist our clients to make the optimal technology decisions for them.

Specifically, clients are looking to D2LT to help to develop pragmatic and cost effective solutions for the digitisation and automation of legal data.

A D2LT System selection approach.