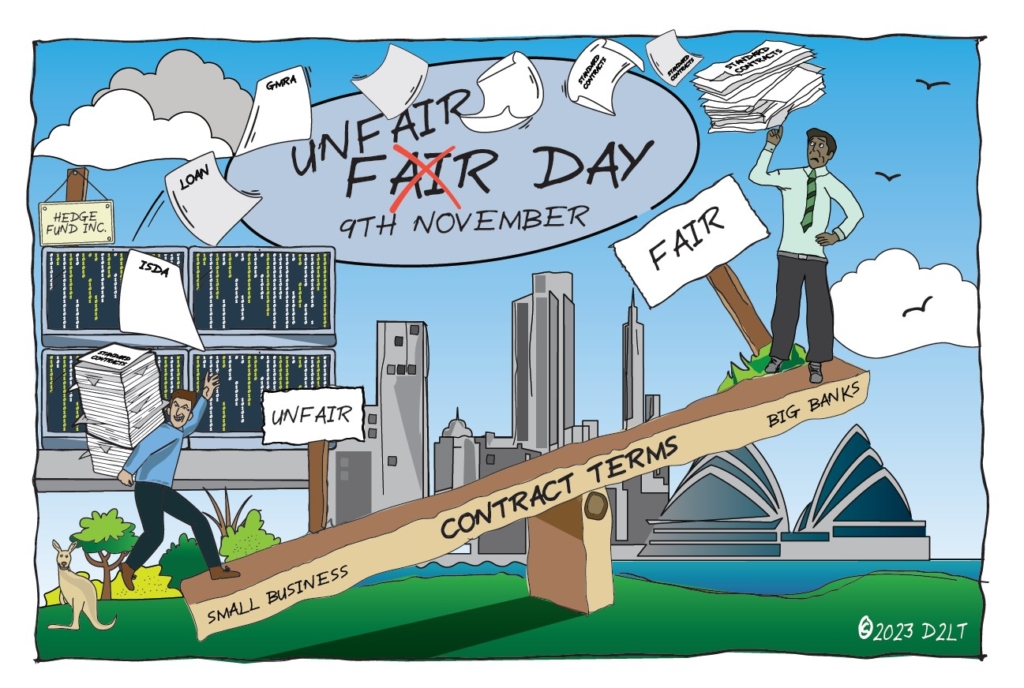

The deadline is imminent for the implementation of updated regulations on unfair contract terms (UCT) in Australia, with the new Australian Securities and Investments Commission (ASIC) rules slated to take effect on 9 November 2023. This impending change in the legal landscape is putting pressure on businesses to remove potentially unfair contract terms from their agreements. Businesses that wish to stay on ASIC’s good side should be ready for these changes by evaluating their standard form contracts to mitigate compliance risks if they have not done so already.

From 9 November 2023 (Commencement Date), changes to the Australian Securities and Investments Commission Act 2001 (ASIC Act) will prohibit businesses from proposing, using, or relying on unfair contract terms in standard form contracts involving small businesses. Rachel Scanlon, Managing Director, APAC; Ola Wesolowska, Legal Consultant; and Andreas Boentaran, Lawyer; from D2 Legal Technology explore the key aspects of these changes, their implications, and how businesses should prepare.

Expanded Definition of a ‘Small Business’ and ‘Small Business Contract’

In order for the UCT rules to apply to a standard form contract, one of the parties must be a ‘small business’ and the contract must be a ‘small business contract’. From the Commencement Date, the definition of ‘small business’ is being significantly expanded. As a result, many more market participants will qualify as ‘small businesses’ under the new regime. According to the revised criteria, a party is a ‘small business’ if at the time the contract was entered into, that party:

- employs less than 100 people (previously 20 people); and/or

- has a turnover of less than $10 million.

An agreement will constitute a ‘small business contract’ if the upfront price payable is not more than $5 million (previously $300,000 or, if the contract was for more than 12 months, $1 million), and at least one party to the contract is a small business. Determining how the upfront price is calculated in the context of complex financial instruments, such as derivatives, presents a material challenge and requires detailed analysis.

Clarifying the Definition of a Standard Form Contract

Businesses need to know what a “standard form contract” is to determine whether their contracts are in scope. The key feature of a standard form contract is that one party dictates the terms of the contract on a ‘take it or leave it’ basis to the other. The upcoming ASIC Act amendments clarify that even if the other party can negotiate minor changes, or select from a range of options, the agreement could still be considered a standard form contract. This makes it easier for a negotiated agreement to be deemed a standard form contract under the new rules.

In the light of this, traded markets contracts like ISDA Master Agreements and Global Master Repurchase Agreements may fall under the UCT regulation’s scope. These contracts may be deemed standard form contracts if presented on a ‘take it or leave it’ basis, or if a party is not given a meaningful opportunity to negotiate the terms, even in cases where minor or inconsequential points have been negotiated.

In determining whether an agreement is a standard form contract, a court will take into account various factors, including inequality of bargaining power, whether the contract was pre-prepared, and the extent of opportunity to negotiate the terms. Further, a court will take into account repeated usage of a type of contract, particularly relevant for financial services providers that regularly enter into master relationship agreements on identical or substantially similar terms.

Determining if Contract has Unfair Terms

A term of a standard form contract that is a small business contract will be unfair if:

- It would cause a significant imbalance in the parties’ rights and obligations arising under the contract; and

- It is not reasonably necessary in order to protect the legitimate interests of the party who would be advantaged by the term; and

- It would cause detriment (financial or otherwise) to a party if it were applied or relied on.

Consequences of Non-Compliance

Non-compliance with the new regulations can result in serious consequences. It will become a civil offence for a party to propose unfair contract terms, as well as to apply or rely on them. This marks a significant shift from the current position where an unfair term is only rendered void, meaning that term was invalid from the start. Each instance of an unfair contract term in a contract will also be considered a separate contravention, which means that multiple breaches can arise under the same contract. Likewise, businesses that apply or rely on unfair terms on multiple occasions would be committing repeated breaches.

Additionally, the updated definition of a small business means that a sizeable portion of Australian counterparties, potentially including investment funds and managers, will fall under the scope of these regulations, and in fact the rules have extra-territorial reach outside of Australia. The change applies to new contracts entered into on or after the Commencement Date or to terms of existing contracts that are renewed, varied or amended on or after the Commencement Date.

In the case of non-compliance, corporations may face heavy civil penalties of up to the greatest of:

- 50,000 penalty units (i.e. $13,750,000);

- The amount of the benefit derived and/or detriment avoided because of the contravention multiplied by 3; or

- 10% of its annual turnover for the 12-month period ending at the end of the month in which breach occurred, or if that amount is over 2,500,000 penalty units, then 2,500,000 penalty units (i.e. $687,500,000).

Hence, whereas no monetary penalties currently apply for non-compliance, corporations that continue to fall foul of the UCT regime after the Commencement Date may face serious financial consequences that they did not face before.

ISDA in Light of UCT Changes

OTC derivatives market participants must ascertain whether their existing agreements fall within the scope of the UCT regime and, if so, assess their ISDA Master Agreements carefully to ensure they do not contain unfair contract terms. This will most likely involve removing or amending clauses that are potentially unfair.

Amending an ISDA after the Commencement Date is likely to require a comprehensive review of existing provisions, potentially turning a simple amendment into a more complex task. The challenge is in identifying potentially unfair provisions (for example unilateral rights of variation, declaration of additional termination events, indemnities, or exclusion clauses) and then putting in place amendments that are commercially acceptable to both parties. Businesses should be prepared for the possibility of a transaction under an ISDA counting as an ‘amendment’ to an existing contract. Many firms have been reviewing their documents and procedures for months, but there will inevitably be work that continues beyond the Commencement Date.

Apart from addressing the issues at the documentation level, organisations must communicate these changes internally. Compliance training on unfair contract terms is vital to ensure the entire organisation understands its obligations under the UCT regime and the increased risk of using, applying, or relying on an unfair contract term. Existing templates and playbooks should be reviewed and updated. Financial services providers may also wish to examine existing contracting procedures to minimise the risk of a contract being found to be a standard form contract and thus subject to the UCT regime in the first place.

Conclusion

From 9 November onwards into 2024, the industry is anticipating an increase in small businesses seeking remedies, going to mediation, filing lawsuits to recover damages, or reporting the unfair terms to the regulator.

For the many firms who have been heavily preparing for the deadline over the course of this year, the deadline will be in sharp focus at the moment. And once the new regime goes live, thinking about unfair contract terms (and the ongoing work that goes with it) will become part of the new normal.