A Beginner’s Guide to AI: Part One

What is AI and what are its applications in financial services? Rachel Scanlon, D2LT’s Asia Pacific Lead, unpacks what you need to know about AI in the first part of our Beginner’s Guide to AI.

What is artificial intelligence (AI)?

The Oxford dictionary defines AI as:

“The theory and development of computer systems able to perform tasks normally requiring human intelligence, such as visual perception, speech recognition, decision-making, and translation between languages.”

AI has become synonymous with clever systems designed to beat clever people at intricate board games, or robots which can overtake humans in intelligence and power. However, the most common uses of AI are in chatbots, retail e-commerce, supply chain and sports betting, all of which are programmed to execute tasks “smartly”.

Three things you need to know about AI

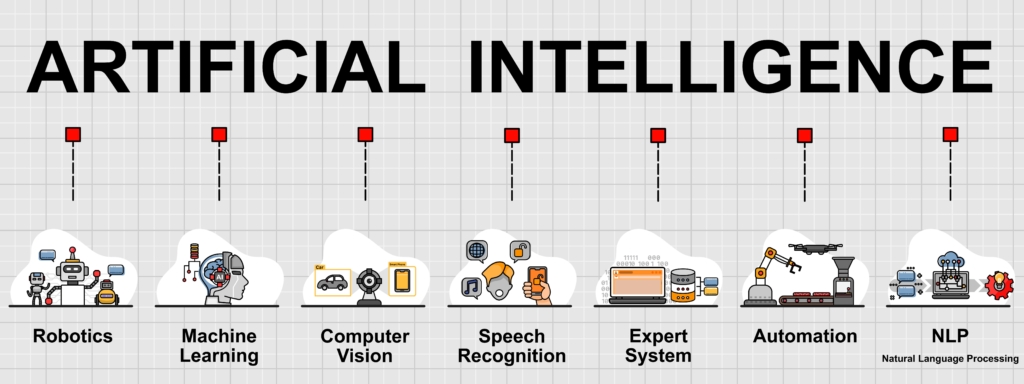

Intelligent computing is made up of a number of fields:

- Machine learning: This happens when computers are programmed with an algorithm or set of rules, which enables them to improve through experience, instead of having all possible outputs coded at the start.

- Neural networks: These are computer systems that copy human brain function, through a system of artificial neurons, that can adapt to different inputs in the same way as people do, and learn accordingly.

- Deep learning or deep neural networks: These take many layers of processing units and make a giant neural network with power enough to take on more complex tasks like speech recognition. Anyone who has ever said “Hey Siri” has tapped into the deep neural network used by Apple for this purpose.

AI development

To give you a sense of how far AI has come, from the 1957 conference at which the term was coined, in 1997 the chess computer Deep Blue defeated world chess champion Gary Kasparov, the first time a computer beat a human in tournament conditions. Now, the most complex chess games are played not between humans and computers, but between two computers, with advanced engines such as Stockfish and Komodo Dragon vying for the most advanced neural network. Earlier this month, Deepmind, a British artificial intelligence company utilised AI to compute the shapes that proteins fold into, solving a 50-year problem in biology and representing one of the greatest achievements of machine learning to date. This discovery was hailed by leading scientists as a “stunning” achievement and a “once-in-a-generation advance”.

AI in financial services

There are multiple applications of AI in financial services, many of which are already in use:

- Contract lifecycle management: In an area of huge growth, AI is changing the way we deal with legal contracts. Information stored in paper or PDF documents can now be extracted and put into structured format for use downstream in the organisation. Contracts can be auto-created, and auto-arranged into a library. Risks in documents can be plucked out by having a machine identify key clauses and dashboards can be designed so that management teams can have far more information at their fingertips than they ever have before.

- Credit decisions: From assessing your home loan, to determining your credit card limit, companies are now using AI to look at your social media, spending habits and past employment information in order to decide how much to lend to you. This may sound simple, but in the past if you had a limited credit record due to being young, having studied for a long time, or having had carer responsibilities, then you might be ineligible for credit. It also would have been labour-intensive to find out all your background information. Banks can now assess you quickly, and be much more efficient if they can lend with precision.

- Trading and asset management: By processing and interrogating vast amounts of publicly available information at lightning speed, AI systems make it easy for analysts to make financial predictions, and for traders to execute trades at the best price. Algorithmic trading has been around for some time, and can be more profitable than normal trading as the emotion has been removed from the decisions. Fun fact: the word “algorithm” comes from the name of a brilliant 9th-century mathematician known as Al-Kwarizmi.

- Robo-advice: Many human financial planners have already been replaced by digital platforms which provide algorithm-driven advice based on information you provide electronically.

These applications are reliant on data, and systems which can integrate and talk to each other. In fact, AI technologies have existed for several decades as noted above, but it is the explosion of the raw material of AI – data – that has allowed its recent incredible advance. Just consider the billions of searches carried out online that provide real time data sets to Google, as one example.

This means that the future of AI is bright, with the top trends in the next few years being increasing use of robots, enhancements to cybersecurity, greater customisation for online marketplaces, and improved digitisation of everything we do.

The law is particularly conducive to the successful application of AI, especially given the legal industry has been slower to embrace technology to date.

In the next part of the series, Robert Peat, Consultant, D2LT, will take a deep dive into the specific applications of AI in the legal sector.